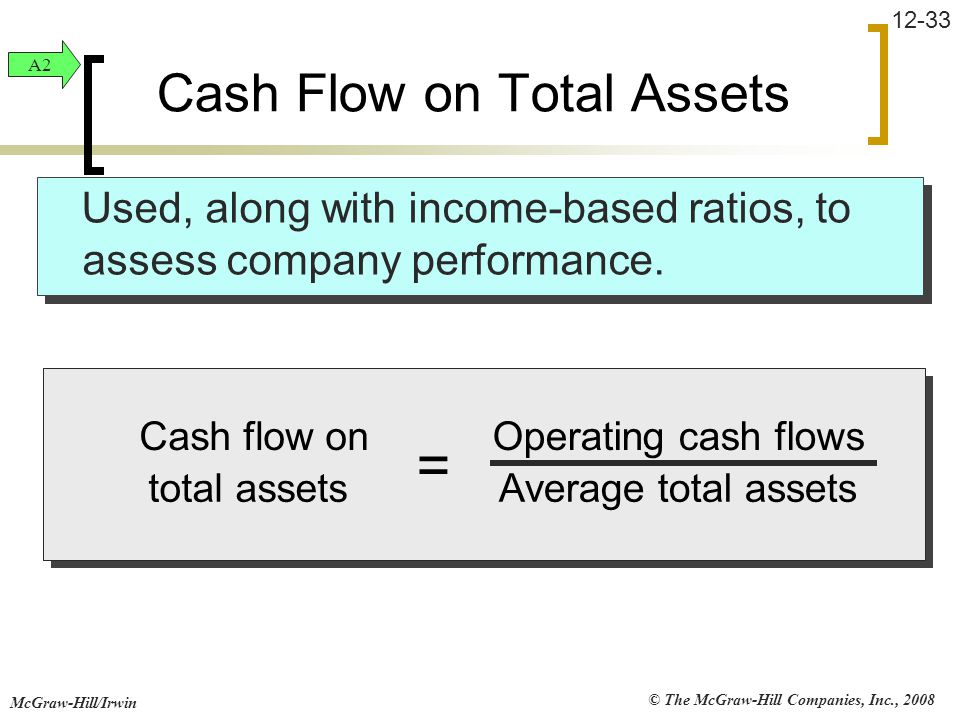

cash flow on total assets formula

We need to calculate the net cash flow. And it generates a large portion of the total value that the discounted cash flow formula produces.

What Is Net Asset Value Definition Formula Examples Snov Io

The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations.

. Operating Cash Flow Example. Cash flow from investing activities reports the total change in a companys cash position from investment gainslosses and fixed asset investments. Read more and Income Statement for 2015.

Generally considered a quick napkin test to determine if the asset qualifies for further review and analysis. Cash Flow from Financing Activities Formula 10000 20000 7000 17000. Cash Flow Coverage Ratio Operating Cash Flows Total Debt.

In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed assets known as capital expenditures. The closer your assets are to being cash the more liquid they are. What It Is How It Works and.

Similarly buying assets will lead to a cash outflow. In investing the cash-on-cash return is the ratio of annual before-tax cash flow to the total amount of cash invested expressed as a percentage. Financing Activities Cash Flow CED CD RP Calculating Net Cash Flow From All Other Activities.

The discounted cash flow analysis also uses the subject companys weighted average cost of capital WACC which represents the companys cost of capital from all its sources as part of. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the US. Stocks land buildings fixed assets.

It is the leftover money after accounting for your capital expenditure and other operating expenses. A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows. It is often used to evaluate the cash flow from income-producing assets.

Free Cash Flow Formula. Cash flow from investing activities reports the total change in a companys cash position from investment gainslosses and fixed asset investments. Basis for Comparison Cash Flow Cash Flow Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period.

The free cash flow FCF formula calculates the amount of cash left after a company pays operating expenses and capital expenditures. Below is an example of operating cash flow OCF using Amazons 2017 annual report. It proves to be a prerequisite for analyzing the businesss strength profitability scope for betterment.

Free cash flow helps companies to plan their expenses and prioritize. Here we discuss the formula to calculate Free Cash Flow to Equity along with step by step examples and when to use this method. This formula is then used to calculate the total cash flow balance.

1 What is Free Cash Flow to Firm or FCFF. A positive percentage here is a good indicator of business profitability and efficiency. A big chunk of his cash flow7000 out of a total cash flow of 13000came from Increase in Accounts Payable.

Cash Flow Statement. DCF theory holds that the value of all cash flowgenerating assetsfrom fixed-income bonds to stocks to an entire companyis the present value of the expected cash flow stream given some. The net Cash Flow formula is a very useful equation as it allows the firm or the company to know the amount of cash generated whether its positive or negative.

Market value of assets relative to their purchase price over a specified time period. From this CFS we can see that the net cash flow for the 2017 fiscal year was 1522000. Accounting Profit Accounting profit is the net income available after deducting all explicit costs and expenses from total.

Securities and Exchange Commission SEC and the. The first step in calculating the cash flow from assets would be a separation of assets into two types. Operating Cash Flow Ratio.

Their assets and growth prospects. Positive cash flow indicates that a companys liquid assets are increasing enabling it to settle debts. The bulk of the positive cash flow stems from cash earned from operations which is a good sign for investors.

There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included. It is that portion of cash flow that can be extracted from a company and distributed to creditors and securities holders without causing issues in its. More Capital Expenditure CapEx Definition.

As you can see the. OCF Total Revenue Operating Expenses. Difficulties with Weighted Average Cost of Capital.

The operating cash flow. Unlevered Free Cash Flow - UFCF. By adding the purchases of intangible assets as per the cash flow statement and deducting the amortization charges which need to be.

The cash flow margin examines the cash coming from operating activities as a percentage of sales revenue in a specified time frame. The appropriate formulas can be copied from one of the existing items and the sheet reference in the copied formula can then just be replaced by the sheet name of the new amortization table that youve added. Cash flow coverage ratio Cash flow from operations total debt x 100 13.

Operating Cash flow margin. Unlevered free cash flow can be reported in a companys. Simply put you calculate OCF using the following formula.

Just like the cash flow from assets that was generating via operating activities we can use a formula to calculate all the cash flows from assets. In order to gain an intuitive understand of Free Cash Flow to Firm FCFF let us assume that there is a guy named Peter who started his business with some initial equity capital let us assume 500000 and we also assume that he takes a bank loan of another 500000 so that his overall finance capital stands at 1000000 1 million. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Cash flow is the net amount of cash and cash-equivalents moving into and out of a business. Calculation of total cash inflows will be. When performing financial analysis operating cash flow should be used in conjunction with net income free cash flow FCF and other metrics to properly assess a companys performance and financial health.

While a cash flow statement shows the cash inflow and outflow of a business free cash flow is a companys disposable income or cash at hand. Based on the accounting equation that states that the sum of the total liabilities and the owners capital equals the total assets of the company. The three main categories of cash flows should cover most cash inflows and outflows that a business experiences often totaling your net cash flow.

Skip to primary navigation.

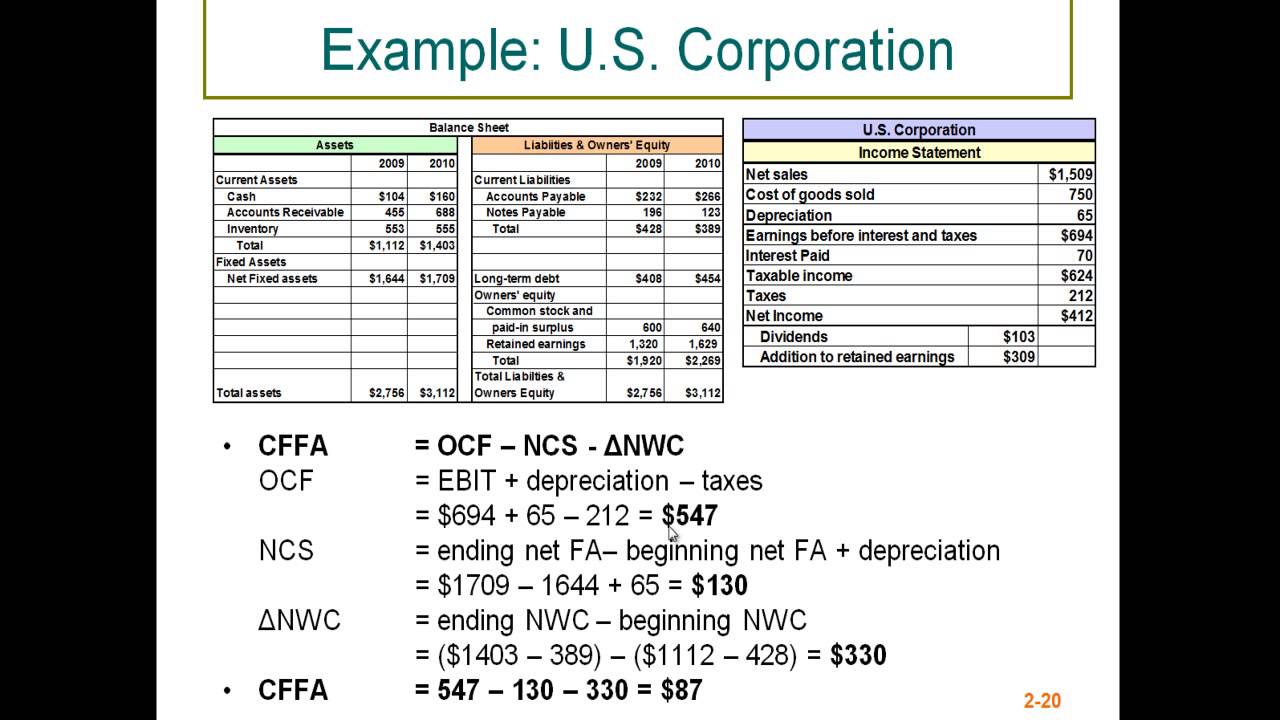

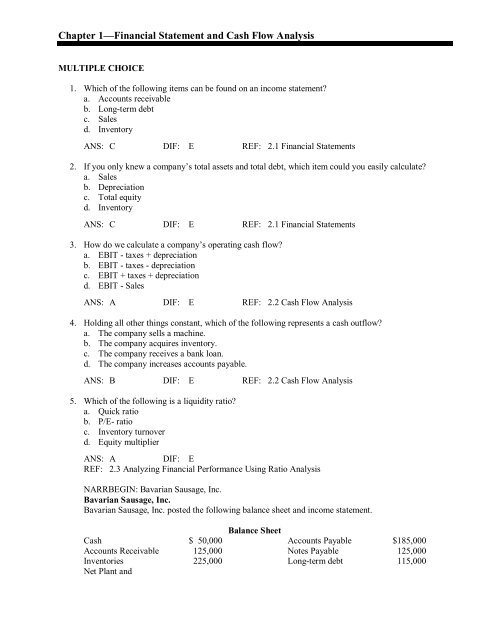

Chapter 1 Financial Statement And Cash Flow Analysis Userpage

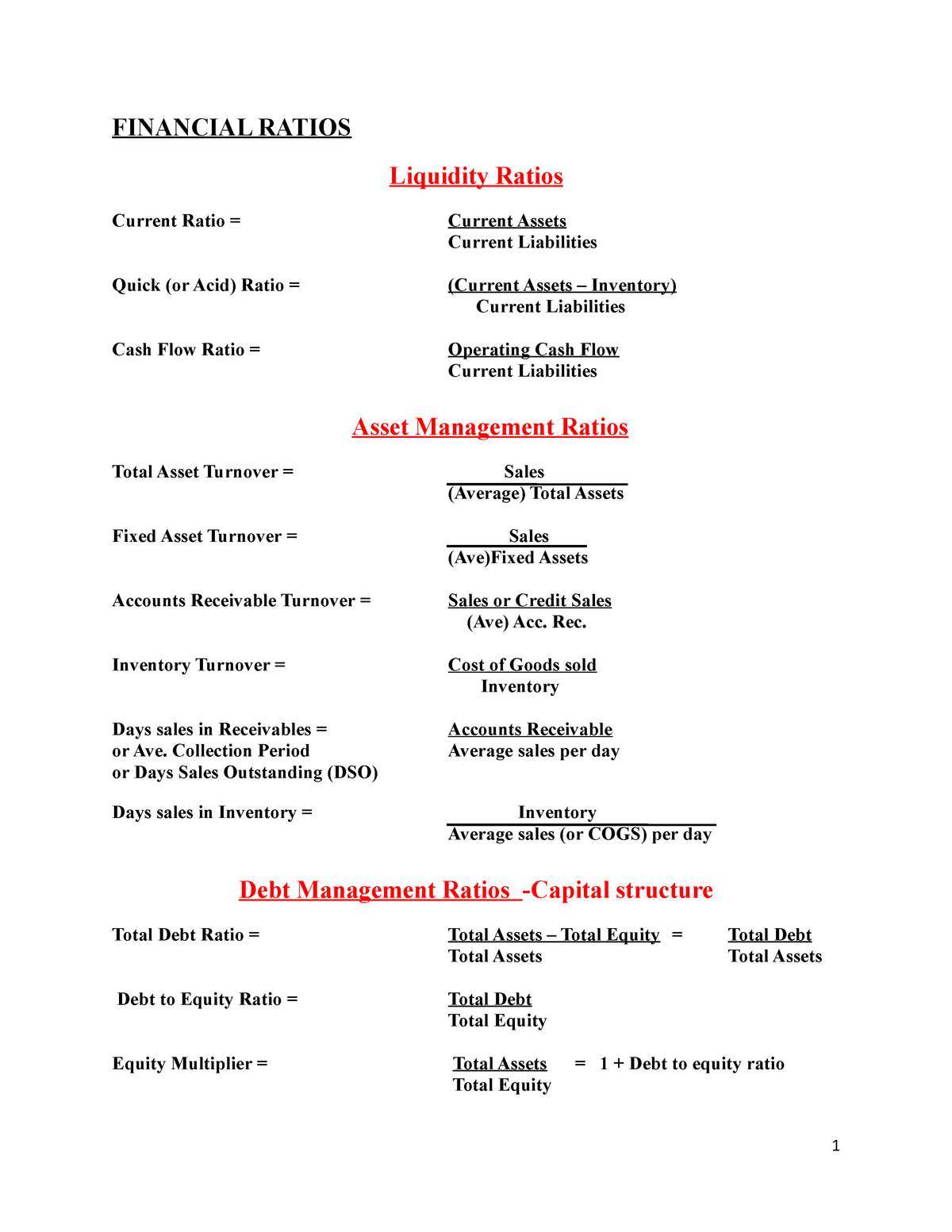

Financial Ratios Revised Financial Ratios Liquidity Ratios Current Ratio Current Assets Current Studocu

/returnonassets-Final-2e535703cfe34c4a84fe21876ebdca98.png)

Return On Assets Roa Formula And Good Roa Defined

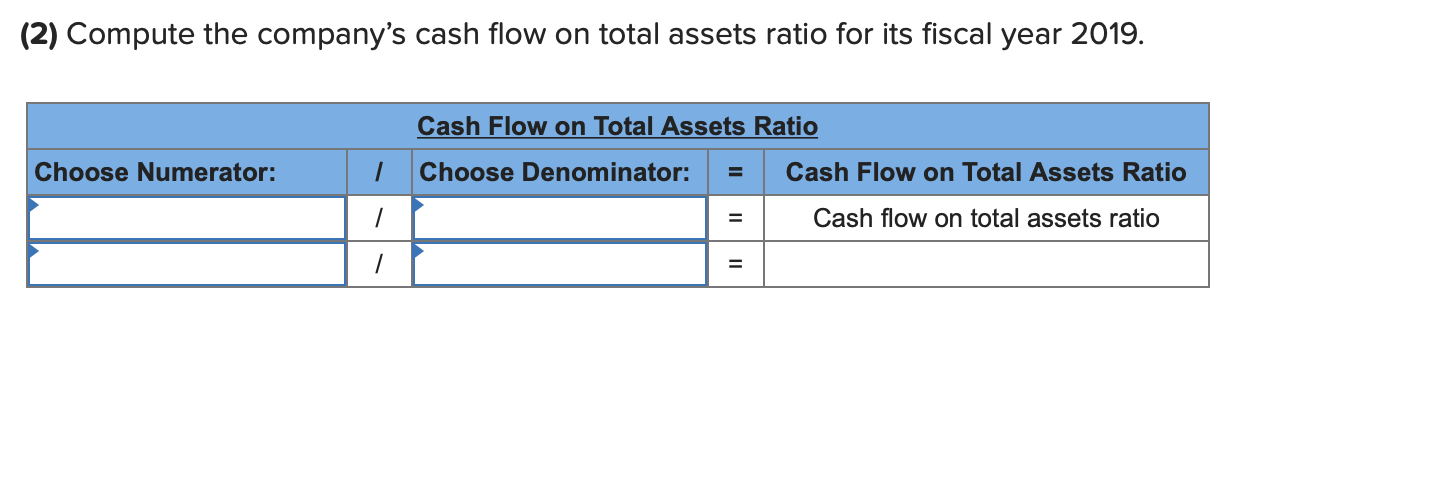

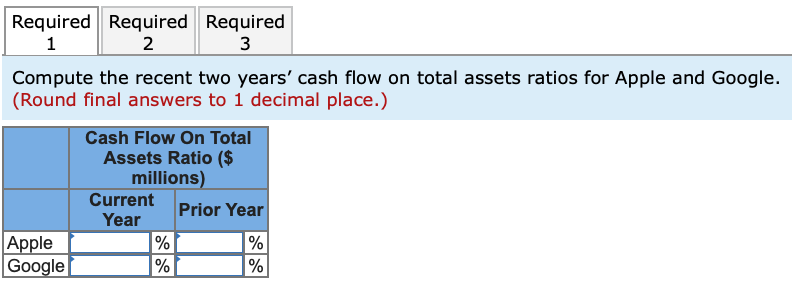

Solved 2 Compute The Company S Cash Flow On Total Assets Chegg Com

Cash Flow To Assets Desjardins Online Brokerage

Solved Key Figures For Apple And Google Follow Millions Chegg Com

The Cash Flow On Total Assets Ratio Is Calculated By A Dividing Average Total Assets By Cash Flows From Financing Activities B Total Cash Flows Divided By Average Total Assets Times 365

The Impact Of Cash Flow Ratio On Coparate Performance Semantic Scholar

Understanding Net Worth Ag Decision Maker

Free Cash Flow Fcf Definition Formula Calculation Example Valuation Model Nopat

Answer To Comparative Analysis A1 Aa 122 Key Figures For Apple And Google Followmillones Studyx

Operating Assets Formula And Calculator

Reporting And Analyzing Cash Flows Ppt Download

Rydex Cash Flow Undermines Market Rally Decisionpoint Stockcharts Com

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

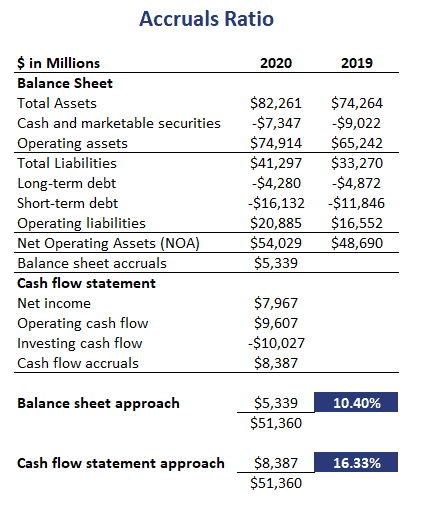

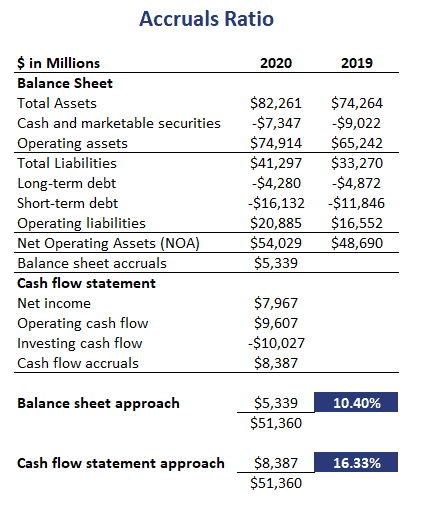

Accruals Ratio Excel Implementation